World Wide Carbon Fee and Dividend

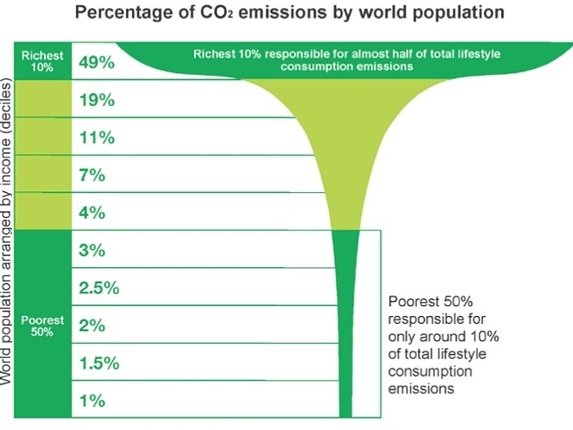

Oxfam graphic: The rich cause most of the CO2 emissions

Worldwide personal carbon budget: 33 tonnes CO2e

(or if we risk 2˚C it’s 115 tonnes)

Carbon Brief reports the remaining carbon budget to give a 66% chance of keeping global warming below 1.5˚C as 243 billion tonnes. That means, if humanity emits 243 billion tonnes more of CO2e global temperature will rise to 1.5˚C above pre-industrial. Using the same calculations, the remaining carbon budget to keep below 2˚C is 843 billion tonnes.

However, we know the climate models that the IPCC used to calculate these remaining budgets (the CMIP5 models) have missing feedbacks and their estimates of temperature rise were underestimates. This means the carbon budgets for given temperature rises are too generous and should be taken as upper limits.

World population was estimated recently at 7,317,801,293 by Worldometers. Dividing Carbon Brief’s remaining carbon budgets by the world’s population sets the remaining worldwide personal carbon budget at a maximum of 33 tonnes CO2e for a 1.5˚C rise or 115 tonnes for a 2˚C rise.

The UK Government aims at a peak temperature 2°C?

But is 2°C safe? Not according to James Hansen. A few days ago, on Australia’s RN breakfast, he said:

Two degrees is a prescription for disaster that’s actually well understood by the scientific community… This number was chosen because it was convenient. It was thought that will give us a few decades so we can set targets for the middle of the century. What the science tells us is that we have an emergency This is actually a global crisis and the science for that is crystal clear.

The UK government is set on 2˚C. Earlier this year Ed Davey, then Secretary of State at DECC said in a speech launching their Carbon Calculator

We need to help people focus on the solutions that work, that add up, that keep the global temperature rise within 2 degrees C. The UK’s approach has been to set in law an ambitious target to reduce emissions by 80% by 2050.

For the sake of argument, let’s examine the optimistic view that 2˚C is safe and the remaining carbon budget per person for 2˚C.

UK emissions: 20 tonnes CO2e per person per year

In a little noticed corner of a report by the Committee on Climate Change, Reducing the UK’s carbon footprint., there is a table showing that the UK’s carbon emissions per person are about 20 tonnes CO2e per year. The much lower figures often reported exclude the carbon emissions created by the manufacture of our imports. We buy goods that when they were made in China and India that are part of our carbon budget. (In December 2012 Professor Sir Bob Watson also described the UK’s rising carbon footprint. At that time he was Chief Scientific Adviser to the UK Government’s Department of Environment Food and Rural Affairs.)

The governments aim in cutting emissions by 80%, takes our emissions down to 4 tonnes CO2e by 2050.

[Note June 2020: The estimate of 20 tonnes CO2e may be too high.

Close inspection (by measuring pixels) of the graph in figure 1.8 of the CCC’s report show emissions due to UK consumption as follows:

2007: 1369 Mt CO2e

2008: 1303 Mt CO2e

2009: 1135 Mt CO2e

2010: 1162 Mt CO2e

Dividing these by the UK population for each year

2007: 22.4 tonnes CO2e per person

2008: 21.2 tonnes CO2e per person

2009: 18.3 tonnes CO2e per person

2010: 18.6 tonnes CO2e per person

Subsequent figures published by DEFRA give lower estimates but there are discrepancies, perhaps due to refinement of the measuring techniques.

For example, in 2015, DEFRA’s figures give 2007 emissions as 1091 Mt CO2e (17.9 tonnes per person) but in 2019 gave 2007 emissions as 997 MtCOe (16.3 tonnes per person). In 2020 the emissions in 2007 were estimated at the lower figure of 977 Mt CO2e. (16 tonnes per person)

Since the large fall in emissions during the financial crash of 2007/8 (a fall of 17% in two years), the consumption emissions of the UK have fallen by just over 1% a year. In 2017 (the last year data is available), they were 772 Mt CO2e per year (11.7 tonnes per person).

The UK is still massively over a fair remaining carbon budget, as discussed in The UK will be over 4 times over budget.

End note.]

UK’s plans for reduced emissions will dwarf the remaining carbon budget

If the UK’s carbon emissions starts at 20 tonnes CO2e per person in 2015 and reduces evenly to 4 tonnes in 2050, our projected carbon emissions to 2050 are 420 tonnes Co2e per person: well over three times our share of the (optimistic) remaining carbon budget of 115 tonnes CO2. On linearly declining carbon emissions, we will have exceeded this budget in a little more than six years.

Could even the unrealistic option of cutting emissions to 4 tonnes immediately get us within our share of the global budget? The answer is no: 4 tonnes CO2e for the 35 years to 2050 is 140 tonnes of CO2e.

Hansen’s Carbon Fee and dividend

James’ Hansen has proposed a Carbon Fee which would tax carbon and return all the proceeds to citizens as monthly cheques. Carbon fees then reduce carbon emissions through a price mechanism, allowing the market to do work. A price high enough would bring very large reductions in carbon emissions.

Given the strong link between consumption between consumption and carbon emissions, the effect of Hansen’s scheme on individual households would be to penalise those with higher consumption and reward those with low consumption. This means it would take from the rich and give to the poor.

The term “fee” is used to avoid using the word “tax” to emphasise that the proceeds are not spent by governments but are given directly back to citizens, defusing political objections to “big government”.

Contraction and Convergence

Aubrey Meyer’s Global Commons Institute (GCI) has an alternative scheme Contraction and Convergence. GCI criticises Fee&Dividend on its website:

100% OF MONEY DISTRIBUTED EQUALLY TO EVERY AMERICAN

So [Fee&Dividend] is not a global cap. Therefore it is – however simple and honest – by definition not a global solution.

In contrast, GCI’s Contraction and Convergence (C&C) is global as it concerns sharing the reduction of carbon emission amongst nations. The Wikipedia article on C&C says

Contraction and Convergence strategy consists of reducing overall emissions of greenhouse gases to a safe level (contraction), resulting from every country bringing its emissions per capita to a level which is equal for all countries (convergence).

C&C gives a framework for countries to negotiate their relative obligations for carbon reduction but it does not specify what happens inside the countries: As long as a country kept to its budget of carbon emissions it could allow a few to use a large proportion of their country’s converged budget leaving the rest with little.

Carbon Fee and Dividend vs Contraction and Convergence

In a international context, the Carbon Fee and Dividend could be a way implement a similar scheme to C&C. An increasing carbon price would be internationally set and fees collected from countries according to their carbon emissions and distributed the revenue according to their population.

However, such a scheme is likely to be opposed by powerful interests resisting payments from the rich countries to poor countries.

Both Hansen and Mayer implicitly recognise this issue. Hansen appeals to the majority of the voters in the United States without mentioning possible international payments. Mayer avoids price mechanisms that involve payments.

Both schemes give the high polluters time mend their ways: Hansen by starting with a low fee which is gradually raised and Meyer by extracting promises from nations that they will do better in the future.

Neither envisage high polluting countries making payments to the low polluting ones.

Being cynical, I interpret the GCI tag line “Climate Justice without vengeance” as a message to the rich powerful countries: “We know you have screwed the climate but your power means that we have to let you off”. Three or four decades ago we could have said “Forgive them Father, they know not what they do.” but for some time the rich nations have been well aware of the climate damage they cause … but still keep polluting big time.

Continuing the cynicism, is Hansen’s avoidance of the international dimension because Fee&Dividend between nations would be too high a price for the most powerful nation in the world?

You may say that I’m a dreamer but I’m not the only one

What if we ignored the emphasis that these schemes put on the world as a collection of nations?

What if a Fee&Dividend scheme were applied to all the people in the world – ignoring national boundaries? Each world citizen would pay a fee to a carbon fund. Each world citizen would receive a dividend from the fund.

Oddly, without recognising it, a small group of people in York started to do this in 1992, called the Pollution Tax Association. We pay a small carbon fee and have given the proceeds to charity, mostly to charities giving help to the poor of the world. As the poor have much smaller carbon emissions than average they should gain much more than our meagre donations … but it’s a start.

Do remember the name World Wide Fee and Dividend (WWF&D) and that a gradual introduction would give a form of Contraction and Convergence.

Postscipt, September 2015: WWF&D inside a Climate Club.

I have recently come across the proposal from Nordhaus of a Climate Club

“Here is a brief description of the proposed Climate Club: the club is an agreement by participating countries to undertake harmonized emissions reductions. The agreement envisioned here centers on an “international target carbon price” that is the focal provision of an international agreement. For example, countries might agree that each country will implement policies that produce a minimum domestic carbon price of $25 per ton of carbon dioxide (CO 2 ). Countries could meet the international target price requirement using whatever mechanism they choose—carbon tax, cap-and-trade, or a hybrid.”

“A key part of the club mechanism (and the major difference from all current proposals) is that nonparticipants are penalized. The penalty analyzed here is uniform percentage tariffs on the imports of nonparticipants into the club region. Calculations suggest that a relatively low tariff rate will induce high participation as long as the international target carbon price is up to $50 per ton.”

This is and excellent idea – but it would be more direct to apply a system that paid contries not to pollute. Within the club, a carbon tax would finance payments to all citizens. This would be an international version of Hansen’s Carbon Fee and Dividend.

If for administrative reasons, it is necessary to make payments internal to each nation, balancing transfers between countries will be made. For a two nation club, there would be payments from the country with the higher average carbon footprint to the country with the lower one.

The incentive for the poorer nations, with lower carbon footprints, would be the transfer payments from the wealthier nations. The poorer nations (like Indonesia) would be paid to keep their pollution low. The incentive for the wealthier nations would be avoiding the effects of dangerous climate change.

For nations ouside the club there would be tariff barriers – perhaps related to the carbon content of their imports.

comment

TrackBack URL :