Climate, planning, economy. Tips 61+

Not ordered by importance.

- #61: Subsidise goods that use lots of labour

- #62: Local inequality in greenhouse gas emissions

- #63: Net-zero is a smoke screen

- #64: Perverse language in IPCC SR15 downplays Ocean Heat Content

- #65: Lucky old Sun – and a common myth

- #66: Cars and choice

- #67: The York Local Plan

- #68: Are BEVs better than ICE cars?

- #69: Does GWP*, cheat on climate targets?

- #70: Land value tax could bring a little fairness

- #71: Embodied carbon and climate

- #72: Food and the remaining carbon budget

- #73: Carbon budgets and transport

- #74: We are not short of land

- #75: Construction and prefabrication

- #76: Pollution in the countryside

- #77: Pollution in towns

- #78: Density and disease

- #79: Greenbelts

- #80: A summary of #71 to #79

- #81: No cars in the city

- #82: Friends, neighbours and architectural determinism

- #83: No more high buildings

- #84: Look, learn and improve

- #85: Five planning policies

- #86: Cheap, neighbourly and doesn’t screw the world up

- #87: Enhanced town planning

- #88: A new Ministry of Works

- #89: Cut methane emissions now

- #90: Cumulative climate damage

- #91: Problems with Garden Cities

- #92: The Paris Agreement restricts the CCC

- #93: Car-free living

- #94: Starter homes for £20K

- #95: Stop the planning racket

- #96: Needed: Green and pleasant jobs

- #97: Fund Lifestyle R&D by planning gain

- #98: Small scale microwave pyrolysis

- #99: Tax income from planning gain

- #100: Raise VAT rates, create jobs

#61 Subsidise goods that use lots of labour

Tax those that don’t.

The rationale is simple, if there is unemployment, there is spare labour . A good way to use that labour is to consume goods that use it. A policy that could bring this about is to “subsidise goods that use lots of labour and tax those that don’t”.

See a report to the European Commission proposed changes to VAT to achieve this.

For those frightened by the word “subsidies”. These were not subsidies that should cause too much anger in free-marketeers. The “subsidies” in this scheme are tax breaks allocated on a uniform for-every-worker basis. Being tax-breaks they are never actually paid out by government, except in the unusual case where the tax breaks exceed the VAT which would have been paid. In correspondence HM Treasury has agreed these tax rebates are not government expenditure.

Greenhouse gas reduction will be very difficult without reducing economic activity. Restricting economic activity will cause the demand for labour to drop. Also machines and robots are rapidly displacing labour.

To safeguard the structure of society, jobs should be preserved. This shows one mechanism for doing that. To repeat

“Subsidise goods that use lots of labour. Tax those that don’t.”

#62 Local inequality in greenhouse gas emissions

Within the boundaries of a planning authority greenhouse gas emissions can vary greatly.

Councils should be trying to persuade – and eventually to cajole – residents in the areas with highest personal emissions to reduce their impact on the Earth. Most local authorities will have areas where emissions are very high.

However, the councils themselves need to know the details of the problem, and start the process of persuasion and cajoling. A website carbon.place can be used as a tool for identifying local areas of high carbon emissions.

As an example, the table below shows how some authorities in Lincolnshire that may benefit from knowing where residents with large emissions live. The table gives emissions for small areas, within the local authority with the highest and lowest average personal emissions.

The small areas are Lower Super Output Areas, which have average populations of 1500 people.

| CO2e: highest emitting area | CO2e: lowest emitting area | Ratio | Local Authority | |

| 13.1 | 4.2 | 3.1 | Grimsby | *1 |

| 10.0 | 2.8 | 3.5 | Lincoln | *2 |

| 13.9 | 2.1 | 6.7 | Scunthorpe | *3 |

| 10.2 | 4.3 | 2.4 | Cleethorpes | *4 |

Within these local authority areas, the emissions of highest emitting areas, vary from 2.4 times to 6.7 times the emissions of the lowest emitting areas. The highest emitting areas will also be much wealthier as well as much more polluting.

| Small areas with highest emissions | Small areas with lowest emissions | * |

| ‘Ageing rural neighbourhoods’ in Wolds | ‘Endeavouring social renters’ in Croft Baker | 1 |

| ‘Ageing suburbanites’ in Hartsholme | ‘Cosmopolitan student neighbourhoods’ in Boultham | 2 |

| ‘Remoter communities’ in Ridge | ‘Constrained renters’ in Ashby | 3 |

| ‘Remoter communities’ in Croft | ‘Primary sector workers’ in Ingoldmell | 4 |

Local planning authorities should note that planning for high carbon lifestyles is contrary to the National Planning Policy Framework, which says:

At a very high level, the objective of sustainable development can be summarised as meeting the needs of the present without compromising the ability of future generations to meet their own needs

National Planning Policy Framework

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1005759/NPPF_July_2021.pdf

#63 Net-zero is a smoke screen

“Should [net-zero emissions] be achieved globally, “surface temperatures stop warming and warming stabilizes within a couple decades,” said Michael Mann,”

https://www.theguardian.com/environment/2021/jan/07/global-heating-stabilize-net-zero-emissions

This gives the wrong impression that if “net-zero emissions” were to be achieved, then the Earth’s Energy Imbalance would be zero (setting aside the steady flow of heat from the molten core).

At net-zero emissions (and stabilised surface temperature), the Earth would have an energy imbalance which would be heating oceans, melting ice and thawing permafrost, but not increasing Earth’s average surface temperature.

The Earth would still be warming (i.e. accumulating heat) and there would be consequences. e.g. sea-level rise, dying oceans and permafrost feedback.

At net-zero warming does not stabilise – only the surface temperature, while Earth’s interior continues to warm.

Emissions need to be net-negative.

Net-zero is a smoke screen.

#64 Perverse language in IPCC SR15 downplays Ocean Heat Content

“Reaching and sustaining net zero global anthropogenic CO2 emissions and declining net non-CO2 radiative forcing would halt anthropogenic global warming on multi-decadal timescales.”

IPCC SR15, Summary for Policy Makers, https://www.ipcc.ch/sr15/chapter/spm/

This actually means that the average temperature of the air just above the Earth’s surface stops rising. This temperature is called Global Mean Surface Temperature (GMST). It can be used as a measure of the heat near the Earth’s surface and in the atmosphere above.

However, this heat is a small percentage of the heat that is accumulated in the Earth by the greenhouse effect. Over 90% of this “greenhouse heat” finds its way into the oceans mostly by direct warming. Other sources of this greenhouse heat are the latent heat of melted ice mass and thawed permafrost.

Broadly speaking, while GMST is above pre-industrial levels, Ocean Heat Content is still increasing, ice sheets are still melting and permafrost is thawing.

It may be true to say “Global Mean Surface Temperature has stopped rising” but only in a perverse meaning of “warming” has “anthropogenic global warming” been halted.

#65: Lucky old Sun & the myth of living on your wages.

(Draft)

Up in the mornin’

Out on the job

Work like the devil for my pay

But that lucky old sun got nothin’ to do

But roll around heaven all dayI’ve got to work for my family

Aretha Franklin – That Lucky Old Sun

Toil for my kids

Work till I’m wrinkled and grey

But that lucky old sun got nothin’ to do

But roll around heaven all day

A hidden myth

There is a myth hidden in these lyrics. Together “Work like the devil for my pay” and “I’ve got to work for my family” imply a hidden assumption. This assumption is that individuals (or families) should be able to be live on wages alone (i.e. by the sale of their labour).

Practically, this is impossible, so policies such as unemployment benefits have been introduced to support those that cannot find work and disability benefits for those unable to work.

This assumption that it is always possible to have a decent standard of living through hard work has an underlying (but inappropriate) morality. It leads policy makers to try to banish poverty through full employment (so most people have wage income) with a high demand for labour (so wage income is as high as possible.)

Producing more stuff damages the climate

Market forces ensure that high paid jobs need high productivity. Full employment with higher productivity means producing more stuff.

Stuff_Produced= Workforce * Productivity

An increase in productivity means more stuff produced.

But more stuff produces more Greenhouse Gases to damage the climate.

Production and Emissions Intensity

Carbon dioxide is the most important greenhouse gas: Its emissions are the major cause of climate change.

The relationship between the level of production and CO2 emissions can be expressed using the factor Emissions_Intensity. So …

CO2 emissions = Stuff_Produced * Emissions_Intensity

[Note: If stuff worth $1000 is produced and the resulting CO2 emitted is 300 Kgs. this would mean Emissions_Intensity is $0.3 KgsCO2/US$. ]

Lower Emissions_Intensity or lower wages

The two equations above can be combined so that:

CO2 emissions = Workforce * Productivity * Emissions_Intensity

CO2 emissions can be reduced by reducing the Workforce, Productivity or Emissions_Intensity. If full employment is desired, the workforce cannot be easily reduced, so a reduction in Productivity and/or Emissions_Intensity is required.

Over several decades, Emissions Intensity has been falling. According to the Global Carbon Project (2018), it is falling about 2% a year globally, but (until the recent disruption of production from the Covid pandemic) emissions have not been falling at all: Atmospheric concentrations of CO2 are still rising.

If the climate is to be saved, CO2 Emissions must fall much faster than falls in Emissions_Intensity. This means producing less stuff. If the workforce is not reduced, the average worker must produce less and productivity per worker must fall. Without correcting mechanisms, this means wages must also fall.

Non-wage income

To avoid poverty, individuals and families must have non-wage income to allow less productive work. e.g. universal basic income or negative income tax. Labour subsidies, could also encourage the market to create jobs with lower productivity.

We must dispel the myth that the economy must be driven at a climate destroying pace just to give a decent wage to the poorest in the world.

Universal non-wage income is required.

See also:

- Oxford Economics 1: Robots and climate

- Before the robots take all our jobs

- Models of reducing carbon emissions

- The job apocalypse and climate change

- Oxford Economics 2: Chasing productivity

- Jobs, training and video games (1993)

#66: Cars and choice

- Choice based car use

- The parable of the smoking carriages

- Choose Venice over Los Angles – and save the world.

- Highway Robbery (1971)

- Lifestyles, carbon emissions and consumer surplus

Research by the University of Leeds found that, providing the choice of other means of transport did not reduce car use:

We have suggested that in this English and Scottish case study decision-makers accept the argument that choice-based approaches will lack effectiveness in reducing carbon, and that substantial change requires changing the conditions and circumstance which shape possible behaviours.

Cars have taken over communal space:

Once upon a time children used to play in the streets. outside their homes, cycle clubs would go out for a spin in the country at the weekend and people would walk around or stop and talk in the city centre streets or their local high street. Now traffic has taken most of the space that was used for these activities. It has in fact, completely taken over the major supply of easily accessible land – the public highway.

Given the choice many would choose to live car-free:

Many would love to get away from the expense, rush and pollution of “modern living” and its mass car use, just as train passengers in the UK voted with their feet when they were able to separate themselves from the smokers: Those smokers stopped smoking on trains rather than suffer the pollution of their fellow smokers.

For the economists: Motorists destroy non-motorists’ consumer surplus:

If one section of the population (e.g. motorists) cause a fall in the

consumer surplus of another section (e.g. bus users), how should

economists regard this? Can it be classed as an external cost?Dr Antoine Dechezleprêtre of the Grantham Institute has kindly allowed me to publish his answer.

The answer is “Yes”.

#67: The York Local Plan

- Silenced at the York Local Plan Inquiry

- The York Local Plan: Climate Change

- The York Local Plan: Exiling the poor

- Submission to the Public Inquiry on the 2018 York Local Plan

In July 2018, I was refused a late submission to the York Local Plan Inquiry. In December 2020, I am still questioning the circumstances of the refusal.

In the summer of 2019, I thought I had another chance so submitted more evidence, and it seemed my submission was accepted and I was given a place on the table at day one of the hearings to present my evidence. I sat through the morning waiting my turn to speak on the plan’s effect on climate change.

However, I was approached during the lunch break and told I could not speak. The screen shot of the video of the session, above, shows me, Geoff Beacon, leaving.

#68: Are Battery EVs better than ICE cars?

In Cars or Planet, estimates of the carbon footprints of cars has a wide range, with lifetime footprints of centering around 40 tonnes CO2e for mid-range Internal Combustion Engine cars (ICE cars) and 25 tonnes CO2e for mid-range Battery Electric Vehicles (BEVs). Both estimates might be higher if top-down methods for estimating embodied carbon were used.

These estimates show most cars as climate killers, easily overwhelming any remaining carbon budget.

A step in the right direction would be to change what cars are and make them lighter and slower:

Most modern cars weigh rather more than 1 tonne and have top speeds well over 70mph: e.g. A Ford Mondeo weighs over 1.7 tonnes an has a top speed of 116 mph upwards.

These cars carry people who, on average, weigh 5% of the car’s weight and in neighbourhoods, villages, towns and cities “twenty’s plenty”. Let’s replace the car monsters with new vehicles, weighing less than 150 kgs designed for speeds less than 20 mph.

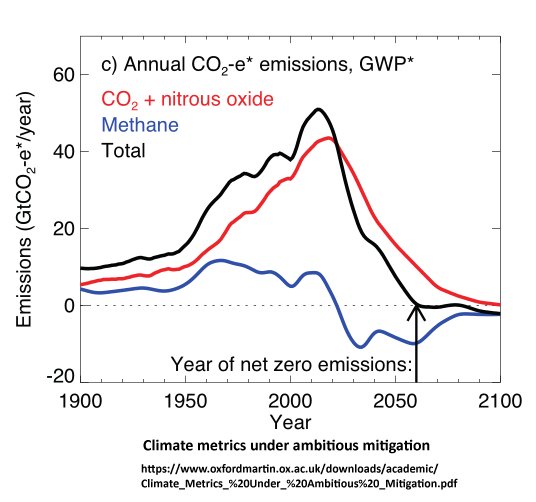

#69: Does GWP*, cheat on climate targets?

When GWP* is “net-zero” CO2 & CH4 emissions are not zero.

- GWP* should not be adopted by the IPCC

- Cheating with temperature

- Instant Earth & Cumulative Earth.

- The CCC should advise the Government that …

A new method of measuring the effects of combined greenhouse gases has been proposed, particularly for measuring CO2 and methane. This new metric may be relevant to the interpretation of international agreements. The Committee on Climate Change says in Land use: Policies for a Net Zero UK :

A new usage of the GWP 100 metric (named GWP*) has recently been developed to recognise the difference in how sustained emissions of methane and CO 2 /N 2 O affect global average surface temperature, which is not fully captured by the current metric.

And :

This new metric will be assessed by the IPCC as part of its forthcoming 6th Assessment Report.

When GWP* is “net-zero” neither CO2 emissions nor CH4 emissions are zero.

Will this be used to move the goal posts for emissions targets?

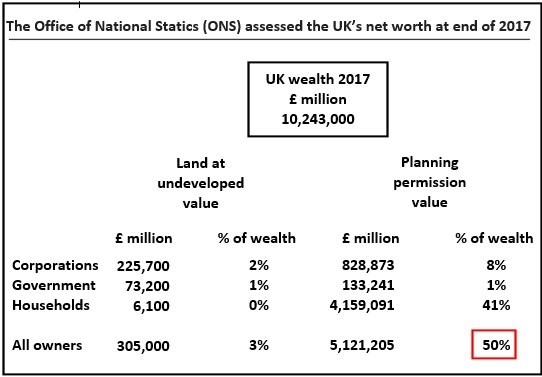

#70: Land value tax could bring a little fairness

It may be desirable to have a managed supply of very cheap housing, but the political power of landowners and house owners would limit such policies.

Mass cheap housing would also worry the Bank of England. It could threaten the stability of banks: Banks which have made loans against inflated house prices.

However, there are other options. Land Value Tax (LVT) is one with a long history. It is supported by a range of political opinions, from the New Economics Foundation to the Adam Smith Institute .

#71: Embodied carbon and climate

The importance of embodied carbon has recently been recognised. The Embodied Carbon Task Force comprises a group of practitioners, academics and developers who have an interest in ensuring that embodied carbon is integrated into normal good practice building design and development. In 2014 it published Proposals for Standardised Measurement Method and Recommendations for Zero Carbon Building Regulations and Allowable Solutions. This says:

–Even before a building is occupied, between 30% – 70% of its lifetime carbon emissions have already been accounted for.

–Embodied carbon makes up the largest proportion of the carbon emissions of a building through its lifetime.

#72: Food and the remaining carbon budget

- Food and the remaining carbon budget

- No beef

- Can DEFRA be trusted with climate

- Defra funded study of beef, tomatoes, etc

Food consumption is a large part of our carbon emissions. Emissions caused by livestock are large but other foodstuffs, particularly produce flown in by plane, can have a very high carbon footprint too.

#73: Carbon budgets and transport

The remaining carbon budget is how much CO2 can be released into the atmosphere to limit global warming to a given temperature.

Tim Jackson has estimated the UK’s fair share of the remaining carbon budget. For a 1.5°C rise (with a 66% chance of success) the UK’s share is 2.5 billion tonnes CO2. With a UK population of 66 million, this amounts to a “fair personal remaining carbon budget” of 38 tonnes CO2.

Rogelj et al. have estimated that to keep the Earth’s temperature rise to a maximum of 1.5°C (with a 66% chance of success) the remaining carbon budget is 320 billion tonnes of CO2. With a global population of 7.8 billion, that amounts to just over 40 tonnes CO2 each.

Researchers at the University of York looked at the new development at Derwenthorpe, York, using their REAP Petite software. Derwenthorpe was meant to be a sustainable development with a low carbon footprint but the results indicated that it achieved a footprint of 14.52 tonnes CO2e per resident per year. (Note: That is per resident not per household.)

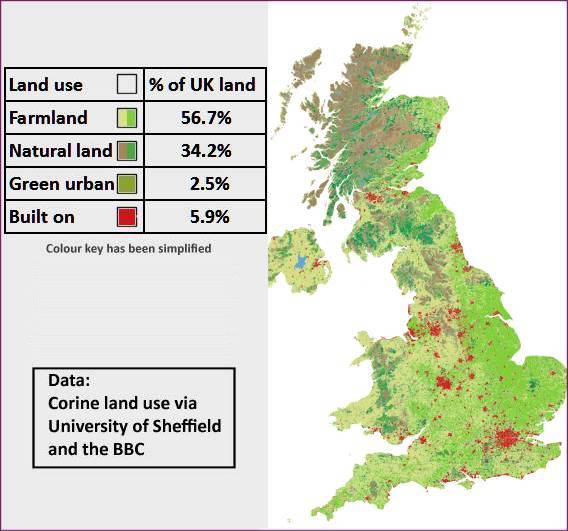

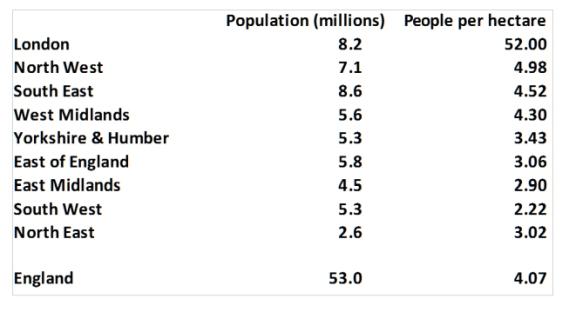

#74: We are not short of land

For the whole of the UK:

- More than half of the land area is farmland (fields, orchards etc),

- Just over a third is natural (moors, heathland, natural grassland etc),

- Under 6% is built on (roads, buildings, airports, quarries etc)

- Green urban is 2.5% (parks, gardens, golf courses, sports pitches etc).

Note that just 6% is built on.

In the UK only the London Region is a bit crowded.

The London Region is ten times more dense than other English regions.

But even the most dense borough in London is Islington at 157 people per hectare is not as dense as Paris (209), Athens(203) or Barcelona (159). Surrounded by the South East Government Region London is within easy reach of expanses of land where people could settle and have a decent life. The South East Region has a density less than one tenth of the London Region.

Planning permision is not a natural resource describes how the planning system creates half the wealth of the UK by increasing the value of land by rationing the supply of “building land”. This is artificial wealth created by government policy.

This wealth benefits land owners and house owners. It takes from the young and poor to give to the old, rich and affluent.

#75: Construction and prefabrication

The cost of building a traditional house is a modest part of the cost of a new home: In York it is less than the cost of the land when it has planning permission. Not long ago it has been possible to build an individual 3 bed roomed house for about £50,000. I know someone had one built for £50,000 – on land they already owned.

New models of building are becoming available. The exciting Wikihouse development, where new technology and open source designs mean the potential house owner has much more control. See the Ted Talk, Architecture for the people by the people, where

designer Alastair Parvin presents a simple but provocative idea: what if, instead of architects creating buildings for those who can afford to commission them, regular citizens could design and build their own houses? The concept is at the heart of WikiHouse, an open source construction kit that means just about anyone can build a house, anywhere.

Other new construction methods include factory made houses such as those planned by Legal and General: Houses made in factories from Cross Laminated Timber (CLT), which sounds like a more substantial version of something we usually call plywood. Sadly L&G seem to have removed their video of the construction process from their website. Rumours that I have heard suggest that the manufacturing cost for L&G houses is £30, 000 per unit.

#76: Pollution in the countryside

The countryside is not as clean and green as it seems. Modern non-organic agriculture has a large carbon footprint, particularly the methane emitted by ruminants (cows, sheep, goats &etc.) and the use of nitrogen compounds derived from the energy intensive Harber Bosh process. The carbon footprint of “modern”, non-organic, food production is large but there are other unwelcome impacts. Three of these:

- Loss of soil fertility

- Insectageddon

- The nitrate time bomb

#77: Pollution in towns

With coal pollution receding, York’s air improved and so did the look of the inner city terraced houses. Since the 1970s they have gradually lightened in colour and their value has risen. Houses that 1948 Plan for York described as “worn out houses” costing a thousand or so pounds in 1970, now sell for over £200,000. That’s a 20 fold increase in real terms.

Now traffic pollution kills

#78: Density and disease

Population density is an important aspect but simple density is not the only driver. Rates of disease are also affected by lifestyles and living conditions.

#79: Greenbelts

Traditionally green belts were seen to stop urban sprawl and were the ‘green lungs’ of the city. This emphasised public health issues such as slum clearance. The policy is seen as a major instrument in terms of protecting the environment against environmental damage as a result of overdevelopment. It is a policy which is believed will to ‘protect the countryside’.

Now green belts are mechanisms for restricting the supply of planning permission.Greenbelt policy:

- — Increases in the value of land with planning permission

- — Gives massive rewards to the affluent (owners of property and land)

- — Penalises the poor and the young

- — Rewards those that pollute the most – the affluent

- — Protects green fields of monoculture with little biodiversity

#80: A summary of #71 to #79

Tips #71 to #79 can be grouped into three sections:

Section 1. The biggest global issue – climate change

- 1: Embodied carbon and climate

- The way we build and the materials used damage the climate.

- 2: Food and the remaining carbon budget

- Modern agriculture and our consumption damage the environment.

- 3: Carbon budgets and transport

- Our travel patterns and means of transport are unsustainable.

Section 2. Planning policies burden the poor

- 4: We are not short of land

- A very small portion of the UK is built-up.

- 5: Construction costs

- Modern methods are reducing construction costs.

- 9: Greenbelts

- Greenbelts protect privilege – at the expense of the majority.

Section 3. Public health & public safety

- 6: Pollution in the countryside

- The countryside is being polluted.

- 7: Pollution in towns

- Towns are being polluted.

- 8: Density and disease

- Good public health allows denser settlements.

#81: No cars in the city

Once upon a time children played in the streets outside their houses, cycling clubs would go out for a spin in the country at the weekend and people would walk around or stop and talk in the city centre streets or their local high street. Now traffic has taken most of the space that was used for these activities. It has, in fact, completely taken over the major supply of easily accessible communal land – the public highway.

It is this gradual and largely unnoticed take-over of this public space that has hidden one of the main disadvantages to mass car transport: the large amount of space required.

Modern town planners are now setting aside areas which can hold the activities displaced by the car: 0n the housing estates they are providing ‘minor open space’; in suburban areas they are providing playing fields and parks; in the city: the shopping precinct.

But today’s ‘minor open space’ isn’t quite the same as the street before mass car use. It is often the land left over after houses and roads have been put on the plans. It becomes a self-consciousness, unnatural space which fails to develop the rich activity pattern of the old-fashioned street. These communual ‘spaces’ are less easily accessible than the car-less streets that were once safe to play and meet on.

The article No cars in the city discusses more of the problems of cars in cities.

#82: Friends, neighbours and architectural determinism

Much of the brutalist public housing built in the 1970s has been demolished.

Their failure has even reached the main stream media, such as the story in The Express, Stop families being herded into high rise, crime ridden tower blocks.

‘Archtectural determinism’ covers a range of beliefs about how architectural surroundings can change behaviour – and to what extent.

The article Friends, neighbours and architectural determinism discusses some of the theoretical approaches that have been put forward.

#83: No more high buildings

Several building methods are suitable for high buildings: steel frame and steel reinforced concrete. Their construction has a negative impact on the environment, which increases with height. As noted in Part 1: Embodied carbon and climate, large emissions of greenhouse gasses are leading us to climate disaster. This means, we should build very few new high buildings – unless a switch to building tall buildings in wood is possible.

The higher the building,whether wooden, steel or concrete, the more complicated the design and maintenance. Lifts, rubbish chutes, external stairs and safety barriers are needed. Tall buildings require better water proofing, sound & heat insulation and a higher level of structural and fire safety. There is much more to go wrong. Designing high buildings requires a high level of design skills.

Requiring better design – and better maintenance – increases cost. When high buildings go wrong solutions are difficult or impossible as with Ronan Point (structure), Hunslet Grange (damp & policing) or Grenfell Tower (fire)

The article Friends, neighbours and architectural determinism discusses the social difficulties.

#84: Look, learn an improve

Robin Hood Gardens: [Andy Burnham’s] ministerial decision endorsed the recommendation of English Heritage that Robin Hood Gardens “fails as a place for human beings to live” and did not deserve statutory heritage protection.

When Oscar Newman visited Leeds School of Architecture in 1976, I asked him how the students could go about designing better housing. I can’t give an exact quote but, as I remember, he said to look for the best housing you can find and design something 5% better. Basically: ‘look, learn and improve’.

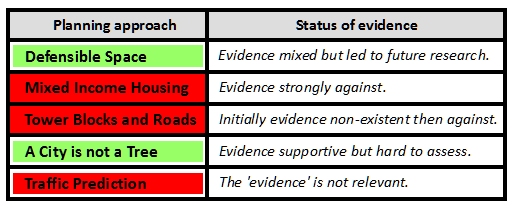

I was shocked that an architect, who had proposed high profile theories of human interaction in housing should say something so lacking in theory: his book, Defensible Space; Crime Prevention Through Urban Design, makes predictions of how people interact depending on the architecture they live in. I had expected an answer involving spatial principles for the layout of housing and the connections between them: Principles on which designs could be constructed.

The article Look, learn and improve discusses how over theoretical approaches to housing failed by looking at the evidence.

#85: Five planning polices

These results show tht an Institute of Enhanced Town Planning is urgently needed.

#86: Cheap, neighbourly and doesn’t screw the world up

- Cheap, neighbourly and doesn’t screw the world up

- Prefabs are for people

- An example of properly low carbon housing

- A sustainable prize winner? Goldsmith Street

For cheap and green housing, these must be eliminated or minimised:

- High buildings (#83)

- Cars (#81)

- Greenbelts and restrictive planning (#79)

- Conventional construction (#75)

- Industrialised farming (#76)

Having eliminated these expensive and unsustainable alternatives, we must look at what remains?One possibility is …

Estates of car-free, wooden prefabs

with integrated market gardens

#87: Enhanced town planning

- The Institute of Enhanced Town Planning

- Topics for enhanced town planning: #1 to #5

- Topics for enhanced town planning: #6 to #10

- New economies for new estates

A new form of town planning is needed, which can design and create new settlement patterns for new ways of living, which are pleasant and low carbon. Local economic frameworks must be part of the designs.

See also

- #86: Cheap, neighbourly and doesn’t screw the world up,

- #88: A new Ministry of Works

- #93 Car free living & happy degrowth.

Government should commission prototypes to create a rich gene pool of settlement types so that the ones shown to work best can become part of our pattern book. There will be a need for criteria to judge ‘success’ but these are almost certain to change as projects progress. Here are some suggestions for parameters to be used in evaluating prototypes:

- Number of residents

- Density of settlement

- Local cost of living

- % of residents employed locally

- % of food produced locally

- % of goods bought from local retailers

- % of goods made by local residents

- Social class of the residents.

- Weekly travel distances.

- Energy and water use

- Carbon footprints of residents

- Protection of ecosystems

- Happiness of residents

- A measure of neighbourliness

These proposed housing settlements can be examined as separate local economies that trade with the outside and have a locally measured ‘GDP’.

#88: A new Ministry of Works

We need a new Ministry of Works, with the brief to create new settlements that are cheap, green and friendly. The aim is to find ways of life that are pleasant and won’t screw the world up. One example would be estates of car-free, wooden prefabs with inbuilt market gardens built around transport hubs, with localised economies created using an enhanced form of town planning .

The New Ministry of Works will take over many of the responsibilities of existing government departments. These departments form a complex system of regulation and control. Experience tells us that changing any complex system must be taken with care. Experience in the development of complex software systems can be used as an analogue.

From Wikipedia:

The Ministry of Works was a department of the UK Government formed in 1940, during World War II, to organise the requisitioning of property for wartime use. After the war, the Ministry retained responsibility for Government building projects.

https://en.wikipedia.org/wiki/Ministry_of_Works_(United_Kingdom)

A new Ministry of Works, should be given wide ranging powers, to develop new ways of life that are pleasant and do not ruin the climate. Perhaps politics means the requisitioning of property is undesirable but in challenging the monopolistic market in land, the use of compulsory purchase should be available.

The Ministry of Works oversaw the building of temporary housing, prefabs. Many turned out to be much more popular than planners anticipated:

In days of lockdown we might compare a prefab with a garden to a multistorey block, which might have balconies. Briefly:

- People liked prefabs

- Multistorey mass housing failed

- The planners didn’t notice

- They will get it wrong again

#89: Cut methane emissions now

Recently, I have found a sources which claims that stopping methane emissions would cause a fall in Earth’s surface temperature of 0.62°C.

Because the Earth is within 0.5 °C of the target limit of the Paris Agreement, the obvious question is “Why don’t we do it?” and stop the fossil fuel industry leaking it, give up beef and lamb consumption and put some international pressure to curtail emissions from rice production in paddy fields. So, let’s start

- No beef

- No dairy

- No fracking

- No rice from paddy fields

#90: Cumulative climate damage

- Cheating with temperature

- Instant Earth & Cumulative Earth.

- The CCC should advise the Government that …

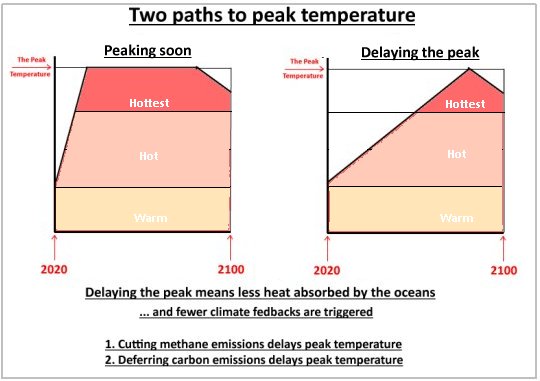

The Paris Agreement aimed to curb greenhouse gas emissions so that Earth’s mean surface temperature (GMST) does not rise more than 2°C above pre-industrial temperatures. Even more, it aimed at keeping the rise to 1.5°C . It is an agreement with a target of a maximum temperature, which should not be exceeded in any one year.

What it does not address is the effects of continuous heating over decades, which cumulatively stores heat in the Earth, causing effects like sea level rise and ice sheet collapse. A target of a maximum surface temperature downplays the feedback effects, which accelerate climate change, such as greenhouse emissions from melting permafrost or the change in the way radiation is reflected away from the Earth.

A maximum temperature does not define the state of the Earth: There may be more or less greenhouse heat stored in the ocean. More or less glacier ice may have disappeared. More or less tundra may have thawed. The Paris Agreement does not account for these.

These considerations are relevant to emissions of short lived greenhouse gases, particularly methane. Its effect on surface temperature dissipates after a few decades, due to chemical decomposition. However, most of the greenhouse heat from its stay in the atmosphere is still stored below the Earth’s surface, mostly as ocean heat content, causing sea-level rise and climate feedbacks.

#91: Problems with Garden Cities

- Garden Cities and Green Evolutionary Settlements

- Had we but world enough and time

- Developments which failed to be low carbon

- A sustainable prize winner? Goldsmith Street

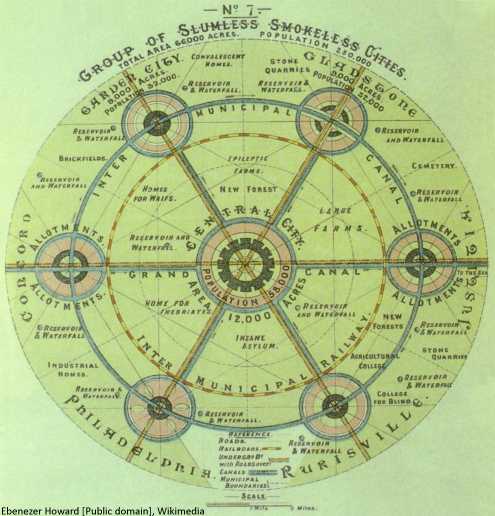

The Garden Cities Movement, started by Ebeneezer Howard, proposes self-contained communities surrounded by greenbelts, containing areas of residences, industry, and agriculture. The Town and Country Planning Association that he founded continues his work.

Planning for a completely new town or city is a large and complex undertaking: The Letchworth and Welwyn Garden Cities took decades to plan and build. Garden cities were planned as new places to live, built on greenfield sites, planned for a better, pleasanter way of life – with walking as the main means of transport.

There are two problems:

- The time left to reduce our greenhouse gas emissions is short and Garden Cities take decades to plan & build.

- Garden cities are separate “new start” settlements. Concentrating effort on stand alone developments does not help to transform the way most people are living now.

A different approach is to plan green extensions to existing urban settlements, which can infuse sustainability into the old structure. These can be called Green Evolutionary Settlements.

These developments must have very restricted car ownership to be sustainable. This is show by examples of the developments in recent years, which have meant to be “sustainable” but have failed, because they have provided for a large proportion of residents having cars.

#92: The Paris Agreement restricts the CCC

The CCC is the Committee on Climate Change.

- Cheating with temperature

- Instant Earth & Cumulative Earth.

- The CCC should advie the government that …

The Paris Agreement aimed to curb greenhouse gas emissions so that Earth’s mean surface temperature (GMST) does not rise more than 2°C above pre-industrial temperatures. Even more, it aimed at keeping the rise to 1.5°C . It is an agreement with a target of a maximum temperature, which should not be exceeded in any one year.

What it does not address is the effects of continuous heating over decades, which cumulatively stores heat in the Earth, causing effects like sea level rise and ice sheet collapse. A target of a maximum surface temperature downplays the feedback effects, which accelerate climate change, such as greenhouse emissions from melting permafrost or the change in the way radiation is reflected away from the Earth.

A maximum temperature does not define the state of the Earth: There may be more or less greenhouse heat stored in the ocean. More or less glacier ice may have disappeared. More or less tundra may have thawed. The Paris Agreement does not account for these.

These considerations are relevant to emissions of short lived greenhouse gases, particularly methane. Its effect on surface temperature dissipates after a few decades, due to chemical decomposition. However, most of the greenhouse heat from its stay in the atmosphere is still stored below the Earth’s surface, mostly as ocean heat content, causing sea-level rise and climate feedbacks.

Because the Committee on Climate Change has been given the Paris Agreement as its main goal for climate mitigation, it is restricted in what it can report to UK Government. I argue that this makes it too optimistic and business friendly.

#93: Car-free living and happy degrowth

- Carbon budgets, car free living and happy degrowth

- Car-free cities and pedestrian apartheid

- Car-free estates of wooden prefabs with inbuilt market gardens

- Pedestrian Apartheid – RSPCA News (1976)

People in households with cars have very large carbon footprints. They also live lifestyles that are expensive, not just because of the cost of running a car but also because the way life is organised.

According to a study funded by the European Commission, car-free cities can be two to five times cheaper to live in. Sadly, the study was not translated from the original French and the Commissioner, Carlo Ripa di Meana got the sack.

Minimising the number of cars is a major step in achieving the degrowth that is necessary to prevent dangerous climate change. Green growth is a fantasy because production cannot be decarbonised fast enough to stay within remaining carbon budgets.

RSPCA News was a competition entry I wrote in 1976 about how to live with less cars.

#94: Starter homes for £20K

Starter homes really could be provided for £20K, if the racket in planning permissions could be stopped and modern methods of construction were used. A plot big enough for a house costs £500 at agricultural prices. In York, this becomes about £200,000 when planning permission is granted – planning gain for the land owner. Muc

Wood construction is good because it can be used to make homes made in factories that can be delivered by lorry and can be ecologically sound.

In a comment after Can your children afford to live in York? on YorkMix, Lisa said:

I was very interested in the article by Esther Dent Dodsworth.

I’ve been living in a holiday home, similar to the place her grandma lived in, on a site near York. At first it was just a stopgap but I’ve grown to really like it and here and I’m thinking of staying permanently. There’s nothing more life affirming than waking up surrounded by nature- woods, birds, the occasional deer and falling to sleep to the sound of hooting owls. The space and the fresh air put a bounce in your step!

The people staying here are friendly, everyone always says hello, and the site manager and wardens go out of there way to make sure you’re okay and can always be contacted, even at night which gives the site a sense of community yet it’s easy to maintain your privacy.

The financial benefits are great. The cost of living in a large caravan for the year is £30 per week and the overheads are low as it costs very little to heat a caravan. The static vans, which have two bedrooms and a bathroom, can be bought between £5,000 and £30,000 depending on how new they are. Many families live here all the year round and find it good way of life.

If people want to live cheaply (& pleasantly), why stop them?

#95: Stop the planning racket

- Planning permission is not a natural resource

- Cheap housing, negative equity and crashing the banks

- What would the Bank of England do if new housing were cheap?

- Nonsense on Land Values

- The York Local Plan: Exiling the poor

The York Local Plan: Exiling the poor makes estimates of the planning gain when permission for one house is granted in the York area. The estimates were the best part of £200,000 per house. This value goes to the land owner (or owner of options on the land).

This planning gain is added to the price of new houses. It happens because supply exceeds demand. Existing house owners benefit because scarcity inflates the values of their properties. The result is that the children of the poor will eventually be squeezed out of York.

However, stopping this racket would worry the Bank of England.

What would the Bank of England do if new housing were cheap?

#96: Needed: Green and pleasant jobs

Production is changing:

- Robots can displace many manual jobs.

- Artificial Intelligence can displace “skilled” jobs.

These cause a fall in employment, BUT this can be offset by increased consumption and production. i.e economic growth. How to get enough growth has concerned economists for many decades’

Pleasant jobs

Less need for labour to produce the goods we consume gives the opportunity for hard working workers working less – or working less productively. Many leave high paid jobs to do jobs they like better so pleasantness versus pay is an option and if pay is a measure of productivity, these are less productive. Policies to support the income of the low paid (e.g. Tip #100 below), would support a trend to pleasanter jobs.

Green jobs

The new problem, which limits growth is climate change. More production causes more emissions of greenhouse gases, which are endangering the Earth’s climate. Jobs must also be greener and cause less climate pollution.

Less productive jobs

It is possible to improve production and generate fewer greenhouse gas emissions. The problem is that in recent decades, improvements have not made emissions fall fast enough to avoid a climate disaster.

The remaining option is to reduce production: Less production means fewer greenhouse gas emissions.. (See Oxford Economics 1: Robots and climate.)

If production is reduced, either

- The number of workers in employment falls.

- The average worker must produce less.

… or both.

For high levels of employment,

jobs with low productivity are needed:

Green and pleasant jobs.

(Tip #100: Raise VAT rates, create jobs can help.)

#97: Fund Lifestyle R&D by planning gain

Innovations in engineering can be funded by the protection that patents give. Patents cannot easily be obtained for innovations in town planning.

Planning gain should be used as a mechanism for funding R&D in town planning.

See Paying for research in Energy, waste and sustainable lifestyles.

#98: Small scale microwave pyrolysis

There should be ambitious engineering research and development to deal with municipal waste. One area should be the development of microwave pyrolysis that can work alongside energy from waste incineration that is connected to local heat networks. Pyrolysis can extract raw materials from waste by heating at high temperatures.

Microwave pyrolysis should operate when renewable energy is plentiful. This can be used to pay for the installation of extra renewable energy capacity which can be used when demand for electricity for other purposes is high. There is also the possibility of using pyrolysis products to generate peak time electricity.

A small scale helps with the integration into local heat networks so that heat from pyrolysis can be used.

See Small scale microwave pyrolysis.

#99: Tax income from planning gain.

Much of this is taken from Housing – part 5: Construction and prefabrication.

When planning permission is granted for a house, the plot of land increases in value. In places where demand for housing is high it can be several hundred thousand pounds per plot.

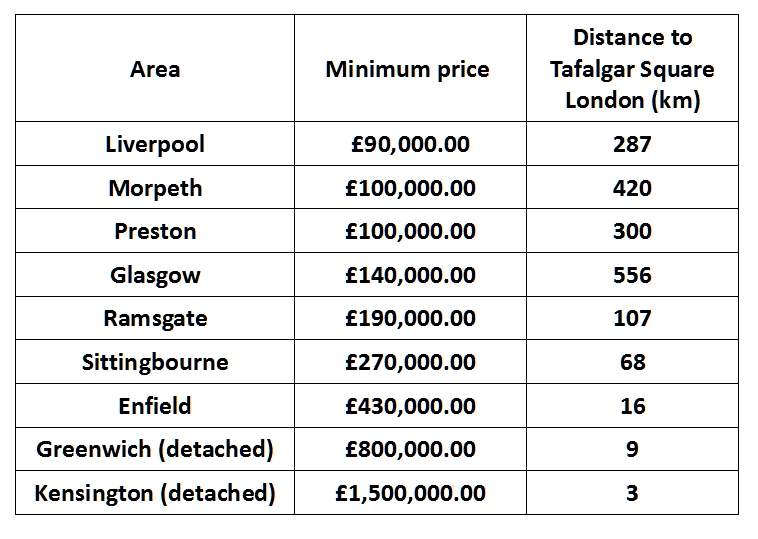

Regional prices for new houses

I looked on Zoopla.co.uk in February 2019 for the price of new build 3 bed semi-detached houses and found these prices, (rounded up to the neatest £10,000).

The cost of building and development does vary a bit throughout the country, but not much. Given the prices above the cost of building a new 3-bed semi cannot be as large as £90,000, let’s assume a figure of £70,000. (Advances in prefabrication will make this much less.)

This means that planning gain per housing plot varies between £20,000 and £360,000, with the places where demand is high, in the £200,000+ range.

Assume that UK Government had a policy of finding green field sites in areas where demand for new housing is high. In these places planning gain would be in the £200,000 range.

If a development tax were applied at a rate of 50%, a million new homes could bring in £100 billion in taxes.

A million homes? That’s just what’s planned for the Oxford Cambridge corridor.

Tip: Tax planning gain.

#100. Raise VAT rates, create jobs.

A scheme to increase nominal VAT rates but to give tax breaks for employing people is described in A macroprudential proposal for employment . The original published scheme kept government finances unchanged. Now new tax income may be needed, higher income from VAT may be needed but so is full employment.

How high can VAT rates go?

When income tax is greater than about 70% the revenue generated starts to fall. This may not be the same for expenditure taxes but since VAT is less than 20% now, there is probably a long way to go before tax saturation.

Points about the original scheme

- 1. The VAT rebate scheme (as published) incurs no government spending or borrowing. (HM Treasury conceded this.)

- 2. Although the VAT nominal rate is increased, the total VAT bill falls due to rebates and savings on unemployment.

- 3. Average prices of goods and services should fall, due to lower VAT take.

- 4. It would boost the wages of the lower paid by increased competition for their labour.

OK, it taxes high productivity (i.e. capital intensive goods and goods with high value added per worker). However, since consumption must be cut for environmental reasons, there must be a less productive workforce if full employment is required. This points to slower, pleasanter lifestyles with less demanding jobs.

Let’s not mess with National Insurance as others have suggested. It is a very comforting fiction for the great British public.

Tip: Raise VAT but aim for full employment with VAT rebates.

——-

P.S. Put a bit more cash into Universal Credit.

—–

TrackBack URL :